The Year 2022 Defines Crypto Risk Management

The year 2022 is the best stress test for crypto fund managers; this is the year that separates the wheat from the chaff, the men from the boys. For crypto fund managers, the year 2022 holds the same significance in stress testing as the year 2008 did for hedge fund managers.

When evaluating crypto funds, investors will look to 2022 as the year which stress tested the risk management of crypto investment managers. Unfortunately, investors will find that many crypto fund managers will have failed this test. Many funds were down from 50%, 60%, to 70%. Some so-called market-neutral traders were down by 10%, 20%, or 30%. On the other hand, some other funds did perform well by coming out flat or even by being slightly positive.

Stress Tests in the Equity Markets

In equity markets, there were years when investors evaluated investment managers based on their performance during a crisis. Examples include the years 1987, 1997-98, and 2008. I remember these crashes vividly; as a young investor, I learned about risk management the hard way.

Black Monday in 1987 was my first investing crisis in the equity markets. I sold my first company for $ 2 million in 1986, and invested it all in the stock market only to see it plummet by over 50% in October 1987. I then panicked and sold everything, only to see these assets recover within a few years. This event taught me a valuable lesson about myself and human behavior during periods of panic and when there is blood in the streets.

I remember the years 1997 and 1998. Victor Niederhoffer’s hedge fund blew up during this period. Listening to him speak to investors made a big impression on me as a young hedge fund manager. In 1998, Long Term Capital Management failed. At that time, I was operating my first hedge fund. We stayed faithful to our quant models, sidestepped the crash, and continued to trade during the recovery. My fund rose 60% net that year and attracted over $100 million of new capital. This taught me that disciplining oneself to stay loyal to one’s quant models when running model-driven trading programs is the only path to success.

I was not trading when Lehman Bros, Bear Stearns, AIG, and many others blew up in 2008 as I had pivoted to another business. I benefited from government stimulus programs that funded my solar power projects. While the world was crashing around me, I was looking for opportunities such as government programs to take advantage of the crash. I then used these programs to help the business I was working on at the time. The lesson here is that there are often unforeseen opportunities during crisis.

Investors will view the crypto winters of 2018 and 2022 as crisis and stress periods for crypto managers. With the blow-ups of Terra Luna, 3 Arrows, Celsius, Blockfi, Voyager, Babel and others, investors will evaluate how crypto fund managers navigated this difficult time and how the best took full advantage of the volatility.

Pythagoras’s Performance during 2022

Those who know me personally know how proud I am of our track record.. According to the Galaxy Vision Hill databases of 50 crypto hedge funds, Pythagoras’ crypto trading funds ranked #1 and # 3 in the Terra Luna crisis and Bitcoin crash during the first part of the crypto crisis in May 2022. The Pythagoras momentum / trend-following strategy rose 13% in May and June of the same year by catching short trends during those months. During the same time, the price of bitcoin was down 50%. The Pythagoras market neutral fund rose 3.3% in May 2022 by buying cheap puts on Luna and delta hedging the puts with perpetual swaps on FTX. The average crypto fund was down -10.74% in May, and -5.48% in June. Only 19% of crypto funds had positive performance in May, and only 24% of crypto funds had positive performance in June.

On a year-to-date basis in the first half of 2022 the Pythagoras funds ranked # 2 and #5 in performance in the same database noted above. They Pythagoras momentum/trend following strategy rose 24% YTD by catching short trends throughout the year. The Pythagoras market neutral fund rose 8% YTD by engaging in volatility arbitrage, providing liquidity in defi and from its current ETH Merge trade. The average crypto fund was down -12.38%. Only 27% of crypto funds had positive performance in 2022 as of June 30.

Pythagoras Performance During Other Periods of Stress

There are several other notable months that are useful to examine from a risk management perspective. In April of 2021, the price of bitcoin dropped from $59K to $53.5K, a drop of 10%. Pythagoras arbitrage fund gained 4.2% net and our momentum fund was up 16.1% net during this volatile time.

In March of 2020, bitcoin prices fell from $8600 to $6400, a 25% drop. Pythagoras arbitrage fund was up 3.4% net and our momentum fund was up 14.5% net during this crisis.

The year 2018 was known as one of the first crypto winters in recent memory, following the 2017 boom. Bitcoin was down 75% during 2018. The Pythagoras arbitrage fund was up 15.8% that year.

From Aug 1 2018 to the end of that year, bitcoin was down 50% while the Pythagoras momentum fund was up 31%.

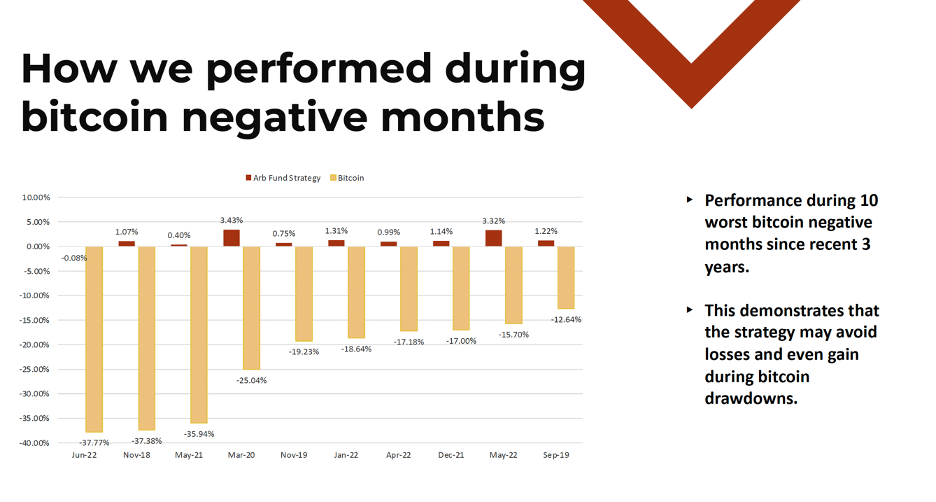

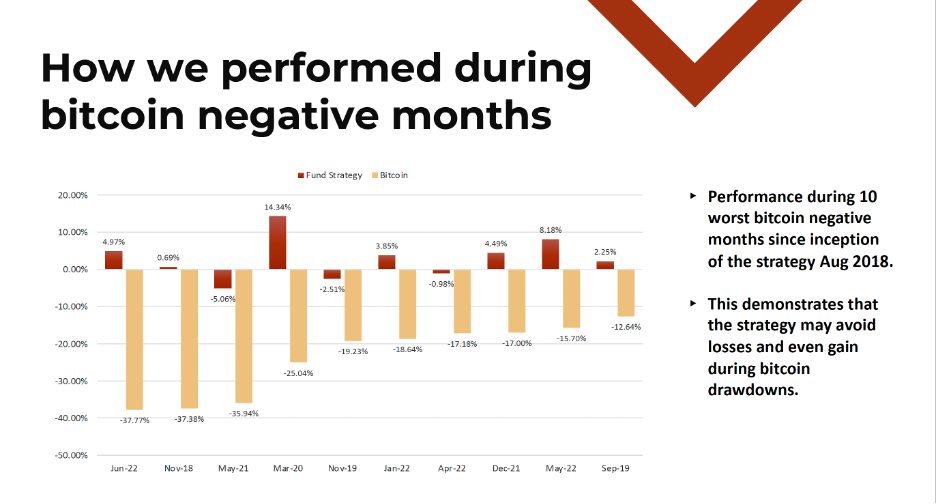

Pythagoras Performance During the Worse Performing Bitcoin Months

The following two charts show how the Pythagoras arbitrage fund and the Pythagoras momentum fund performed during the 10 months with the biggest drops in bitcoin prices.

As you can see from the above chart, the Pythagoras arbitrage fund was down one in one of the 10 worse months for Bitcoin performance. This is not surprising as the arbitrage fund is a market-neutral fund, i.e. it has no exposure to the price of bitcoin at any time.

As you can see from the above chart, the Pythagoras momentum fund was down in only 3 of the worse performing bitcoin months. In the absolute worse month, when bitcoin was down 38%, the momentum fund gained 5% net. Pythagoras’ best month, when it was up 14.3% net, was when bitcoin experienced a 25% loss.

Conclusion

Pythagoras funds are absolute return funds, i.e., they are designed to have positive returns regardless of market conditions, bull or bear markets. They focus on extracting alpha from the markets with no beta. They focus on exploiting the inefficiencies in the nascent crypto markets. The Funds typically thrive on volatility not necessarily directionality.

Although the Pythagoras funds underperform long only or long-biased funds during bull markets when others are up 100%, 500%, 1000% or more, we firmly believe that risk management is key to survival and thriving in a tough market as in 2018 and 2022. While many other crypto-directional funds are struggling in 2022, Pythagoras’ emphasis on risk management is reaping rewards. After all, slow and steady wins the race.

Let me be clear here: past performance is not indicative of future results and trading in cryptocurrencies has greater risks than many other investments. Nevertheless, our track record demonstrates that in the past we successfully navigated the risks that we faced at that time.

Last Updated: Oct 15, 2022